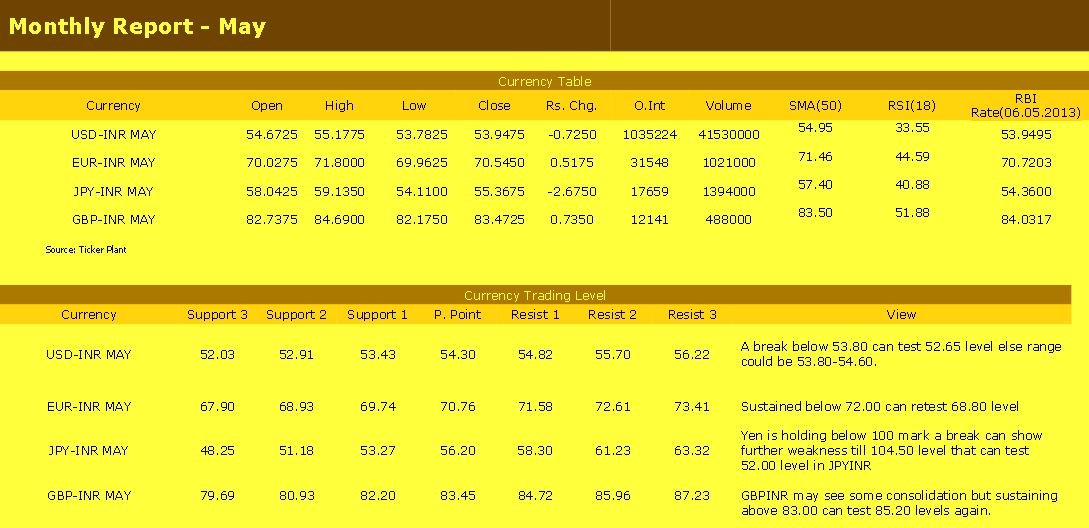

USD-INR MAY A break below 53.80 can test 52.65 level else range

could be 53.80-54.60.

EUR-INR MAY Sustained below 72.00 can retest 68.80 level

JPY-INR MAY Yen is holding below 100 mark a break can show

further weakness till 104.50 level that can test

52.00 level in JPYINR

GBP-INR MAY GBPINR may see some consolidation but sustaining

above 83.00 can test 85.20 levels again.

Latest Update

The Reserve Bank of India cut its benchmark repo rate by 25bps to 7.25% and adjusted its interest rate corridor accordingly leaving the reverse repo rate

lower by 25bps (now at 6.25%) and its lending rates down by a commensurate amount too (now at 8.25%). The logic of the rate cut is that India is not

growing at a desirable pace with GDP at 5% y/y in Q1 2013 and export growth fluctuating between being flat and lightly positive on a year-on year basis. The

challenge that India confronts is that inflation is running rampant, with CPI notching a lofty 10.4% y/y print in March. A slight slip in wholesale prices in March

gave the RBI room to justify yesterday’s marginal interest rate cut, but as the statement noted, “Overall, the balance of risks stemming from the Reserve

Bank’s assessment of the growth-inflation dynamic yields little space for further monetary easing.”

Market Roundup

• Foreign Exchange - Shifts in investor sentiment will continue to be reflected in the value of the rupee, as the country suffers from a large current

account deficit, a negative sovereign credit rating outlook, weak government finances, and political instability. Nevertheless, a relatively

temperate fiscal plan combined with further monetary stimulus to boost economic growth prospects should provide modest support to the rupee.

• Sovereign Debt & Credit Ratings - India’s sovereign credit rating outlook is negative, with the country at risk of losing its investment grade

rating. Standard & Poor’s and Fitch maintain a “negative” outlook on India’s “BBB-” ratings (in place since in April and June 2012, respectively),

highlighting fiscal challenges, the risk of erosion in the country’s external liquidity, and weakening outlook for the country’s growth potential that

reflects lagging advancements on the structural reforms required to boost business and private investment. Moody’s has assigned India an

equivalent long-term foreign currency rating of “Baa3” with a “stable” outlook.

• Economic Outlook & Growth - India’s economic performance remains subdued, challenged by limited fiscal room and still-subdued global demand

conditions. Output expanded by 4.5% y/y in the final quarter of 2012 compared with a 5.3% gain in the July September period, limiting the

overall economic expansion to 5.0% in 2012. Nevertheless, a gradual improvement is in sight; Market expects India’s real GDP to advance by

6¼% in 2013-14, though gains will continue to fall short of the close to 8% annual average recorded over the past 10 years. Consumer spending

growth remains muted relative to historical standards due to weak confidence, while investment is restrained by structural limitations, such as

poor infrastructure and a complex regulatory environment. Nonetheless, investment should be bolstered by the administration’s plan to speed up

the approval and implementation of large projects. In addition, monetary policy easing and implementation of economic reforms will improve

business sentiment. While the Indian economy is more domestically driven than many of its regional peers, net exports will continue to be a drag

on growth as import demand surpasses India’s shipments abroad.

• Inflation & Monetary Context - India suffers from persistently high inflation, though price pressures as measured by the whole sale price index

(WPI) have eased in recent months, measuring 6.8% y/y in February compared with 8.1% in September. Markets expect annual WPI inflation to

remain in the 6-7% range through 2014. Until recently, high inflation combined with India’s twin deficits had restricted the central bank’s ability

to implement meaningful monetary policy accommodation to counter subdued economic conditions and to encourage investment. Now, monetary

easing seems more viable on the back of a favourable trend in inflation, some promising economic reforms underway combined with a

reasonably prudent budget for the 2013-14 fiscal years. Market expects the Reserve Bank of India to loosen monetary conditions cautiously in

the coming quarters, after reducing the benchmark repo rate in January and March by a total of 50 basis points to 7.50%.

• Fiscal & Current Account Balance - India’s federal budget for fiscal year 2013-14 (April- March) targets a deficit of 4.8% of GDP, down from an

estimated 5.2% of GDP in the current fiscal year. While projecting a slight improvement in government finances, the budget can be classified as

pro-growth since expenditure will remain elevated in order to provide support to the economy. Nevertheless, the document is fairly prudent

considering the fact that general elections are due in 2014. At the general government level fiscal shortfalls remain substantially larger, above

8% of GDP through 2014. A continuously widening trade deficit will likely be more than offset by a solid performance in services exports and

stronger growth in remittances. Therefore, market expects a modest narrowing of the current account shortfall, with the gap averaging around

4⅔% of GDP through 2014.

• Financial Sector - The asset quality of Indian banks will likely remain under pressure in the coming quarters due to the relatively subdued

economic performance. Nevertheless, consumer loans continue to perform reasonably well on the back of solid employment conditions, with the

non-performing loans ratio at 3.4%, according to the International Monetary Fund. The banking sector’s Tier 1 ratio of slightly less than 10%

suggests sufficient capital adequacy. Indian banks’ capital levels are supported by the government’s stated commitment to a well-capitalized

financial sector.

ECB pulls the trigger: For the first time in almost a year, the ECB lowered interest rates, to a record low of 0.50%. The rates had been pegged at 0.75% since

July 2012. Market had expected the cut, as the Eurozone economy remains sluggish, and many of the major European economies have been bitten by

recession. However, the markets reacted negatively to comments by ECB head Mario Draghi that the ECB would consider a negative deposit rate for banks. The

deposit rate, which is what the ECB pays Eurozone banks for overnight deposits, currently stands at 0%. The euro was down more than one cent on Thursday

as a result. While the FOMC policy statement was a non-event on Wednesday, as the Fed basically noted that it wasn’t willing to take further steps, despite

weakness in the economy. This was a relatively hawkish statement from the Fed, which tends to be more dovish. Currently, the Fed is purchasing $85 billion in

assets under the QE program, and did not indicate any changes were coming. The Fed did take a shot at the government’s economic policy, saying that current

fiscal policy was restraining economic growth. Also the US has been struggling with weak releases since late March, so a couple of strong releases on Thursday

were welcome news. The trade deficit narrowed from $43.0 billion to $38.8 billion, easily beating the estimate of $42.1 billion. Unemployment Claims came in

below expectations for the second straight week. The key indicator dropped from 339 thousand to 324 thousand, blowing past the estimate of 346 thousand.

We’ll get a better picture of the US employment situation on Friday, as the US releases Non-Farm Payrolls and the Unemployment Rate. Meanwhile a loud sigh

of relief could be heard in the markets, as Italy announced earlier in the week that a government had been formed. Although the new coalition will have its

hands full with economic challenges, there was some good news this week from economic indicators. Italian 10-year bonds were down, dropping below 4%.

This is an important sign of renewed investor confidence in the Italian economy. There was further positive news as the Italian Monthly Unemployment Rate

nudged lower, from 11.6% to 11.5%. This beat the estimate of 11.7%. On Thursday, Italian Manufacturing PMI came in at 45.5 points, above the forecast of

44.9 points. If the markets see more good news out of the Eurozone’s third largest economy, the euro could push higher. German data looked sluggish last

week, and Tuesday’s numbers were mixed. Retail Sales declined 0.3%, below the estimate of 0.2%. Unemployment Change came in at 4 thousand new claims,

worse than the estimate of two thousand. On the bright side, Consumer Climate rose to 6.2 points, beating the estimate of 5.9 points. In order for the

Eurozone to stage a recovery, Germany’s weakness was an important factor in the ECB’s decision to cut rates, and the Eurozone will be unlikely to recover if

German numbers don’t improve.

Outlook: EURUSD look to trade under pressure as long trading below 1.3310 levels we can see prices testing 1.2660 levels. While EURINR look weak to test

68.80 level again one can take short in the range of 71.00-71.20 level with SL 72.20 for the target 68.80 level.

GBPUSD shot higher last month, as the pound gained about 250 points against the US dollar. The pound had a quiet week until Thursday, when the UK

released a better than expected GDP for Q1. This enabled the pound to post a rally late in the week. The markets were pleased as the key release climbed

0.3%, beating the estimate of 0.1%. As well, GDP rebounded nicely from Q4, which declined by 0.3%. GfK Consumer Confidence continues to look weak, as

the indicator posted a reading of -27 points. Net Lending to Individuals came in at 0.9 billion pounds, matching the forecast. M4 Money Supply declined 0.9%.

The estimate stood at 0.4%. Mortgage Approvals came in at 54 thousand, just above the estimate of 53 thousand. While Nationwide HPI declined by 0.1%,

surprising the markets which had expected a 0.3% gain. Manufacturing PMI rose to 49.8 points, easily beating the estimate of 48.6 points. MPC Member Ben

Broadbent spoke in London. Construction PMI was up sharply, hitting 49.4 points. The estimate stood at 48.1 points. GBP/USD was steady; as the pair was

trading at 1.5550. Market begins with resistance at 1.5875.

Outlook: Pound look to see a drop till 1.5420 levels which could be a good level to enter for the target of 1.5650 levels. While GBPINR look weak to test 83.20

level again as firmness rupee can create pressure but sustained above 83.00 level can test 85.20 level soon..

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

No comments:

Post a Comment