Weekly roadmap for Nifty

cash

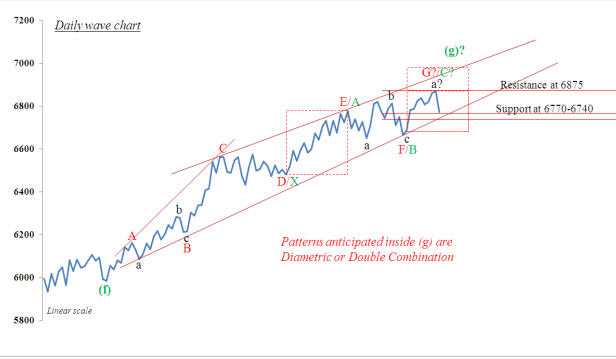

Analysis : Anticipation for next 2-3 months.

Monthly wave chart updated till 31/03/2014

1. The pattern

anticipated from the end of wave circled c (red) is Diametric

and currently, wave (E) is unfolding.

2. The wave (E) is again unfolding

as Diametric and currently

wave (g) inside (E) is in

progress.

3. The above mentioned

wave (g) already reached its given minimum

target of 6420 and has crossed above maximum target of 6620 and hence the scale is changed from

linear to logarithmic.

4. Since the Nifty cash is in last leg of wave (E), the completion of Diametric inside wave (E) may open index for downward move as wave (F) which may fall till

minimum of 5930

and maximum

of

5700. The

target area

of 5930-5700

is expected to reach before end of June 2014.

5. To profit from the expected fall, we must anticipate the end of wave (E). To anticipate end of wave (g), we need to know the maximum

level till which Nifty cash can move up and the important resistances levels (which can act as turning points) below maximum level. The maximum upside for wave (g) is till 7150. Kindly note, it is not necessary for wave (g) to touch 7150 level; it is just the maximum level till which Nifty cash can move up. The maximum levels are touched only in extreme conditions and never in general conditions. Please also note

that the coming Elections can generate

extreme conditions.

6. The 6778 level seems to be important

and crucial resistance level and can act as a turning

point. Till date, the index has made the high of 6776.75

and is currently hesitating to

move up.

7. Since the confirmation of completion of pattern comes late on bigger time frame charts,

we need to analyze

weekly wave chart to get the evidence of pattern completion.

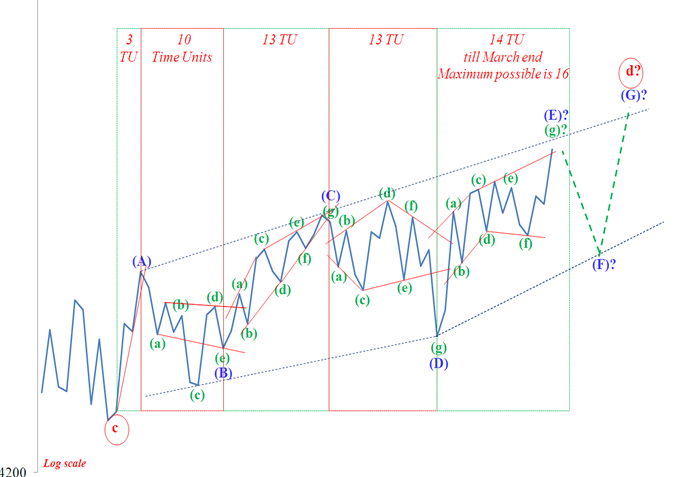

Analysis : Anticipation for next 3-4 weeks.

Weekly wave chart updated till 04/04/2014

1. The

wave (g) has consumed 17 time units till 4th April

2014 and seems to be around completion.

2. The

completion of wave (g) will also complete wave (E) and may open Nifty cash for

down move which may fall till 5930 on or before 6th June

2014.

3. The

confirmation of completion of wave G will come if 6660 is breached on or before

11th April 2014. Thereafter Nifty cash needs to cross below 6470 on or

before 18th April 2014 to confirm the completion of wave (g).

4.

In case, if Nifty cash crosses above 6778 (without moving below

6660) then the index is heading for higher levels. In this case, the counts on

weekly wave chart may change in future.

Note : The clarity on daily chart is very low and hence is not

presented in this report. But the cross below 6675 on 8th April

2014 will increase the probability of reversal. If 6675 is crossed on 8th April

then we need to watch 6660.

Conclusion

For confirmation of reversal and pattern end (which

started from 5933.30), we need a sequential unfolding of specific retracement

events. They are as below

1.

The breach below

6675 on 08th April 2014.

2.

The breach below

6660 on or before 11th April 2014.

3.

The breach below

6470 on or before 18th April 2014.

The faster the above events happen, the better for

reversal. If the above events take place then we can expect 6200 till end of

April 2014. The breach of 6470 on or before 18th April 2014 will also confirm

that Nifty cash is going to move below 5930 on or before 6th June 2014.

Kindly note, the breach above 6778 will negate the

expectation of fall.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!