Hello everybody,

A high probability short trade in the Nifty may be around the corner. Please go through update.

Date : 11/03/2014

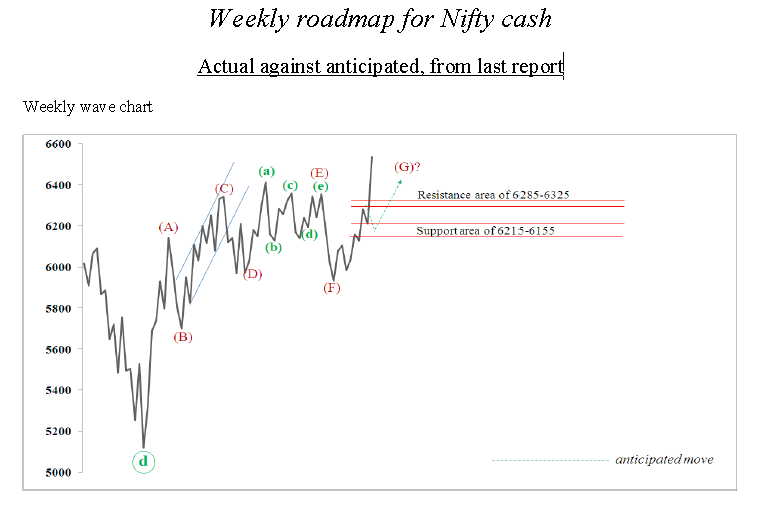

Update on weekly roadmap for Nifty cash

Daily wave chart updated till 11/03/2014

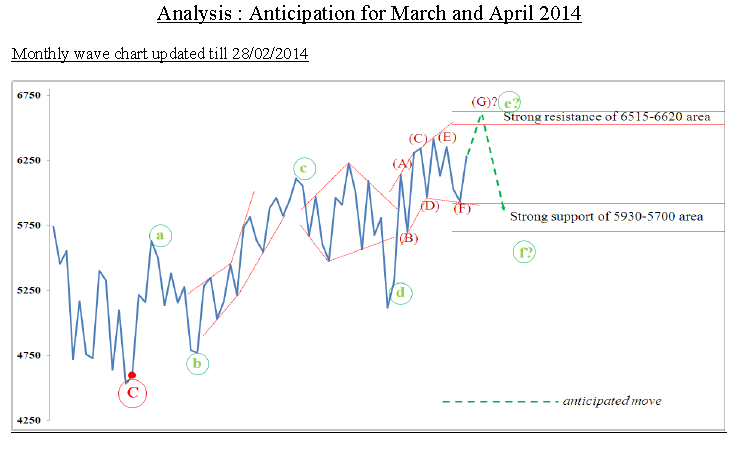

In weekly report dated 08/03/2014, it was mentioned that the Diametric which started

from 5318.90 may end somewhere below 6620 (provided the wave (G) of anticipated

Diametric is a standard corrective pattern).

Kindly note, the NeoWave pattern becomes clear when it is very near to its completion.

The wave (G) is probably very near to its completion. The wave (g) of (G) seems to be

Complex correction ending with Contracting Triangle (with reverse alteration).

If so is the case then Nifty cash should not move above 6570 in any case and the anticipated

Contracting Triangle may end in 6531- 6555 area.

The completion of wave (G) will open Nifty cash for down move which may reach till minimum of 5950 before 18th April 2014.

Since the pattern completion is anticipation, therefore entering a short trade requires

certain conditions to be fulfilled by Nifty cash and

they are:

1. The Nifty cash must move up till minimum of 6532.

2. It should in no case move above 6570.

3. After making top somewhere between 6532 and 6569, it should move down and cross below 6490.

4. All the above things should take place on 12/03/2014.

5. If all the above conditions are fulfilled then one can enter short on cross below

6490 with stop loss above 6570 for target of 5950. The target may reach before

end of 18th April 2014.

6. The aggressive traders can enter short on cross above 6532 with stop loss above

6570 for the same target.