Friday 28 June 2013

Monday 17 June 2013

RBI's Credit Policy (17th June 2013)

RBI’S CREDIT POLICY – 17th June 2013…All Key rates kept

unchanged

·

Cash Reserve Ratio

– The cash reserve ratio (CRR) of

scheduled banks has been retained

unchanged at 4.0% of their net demand and

time liabilities (NDTL).

·

Repo Rate – The repo rate under the liquidity adjustment facility (LAF) has been retained

unchanged at 7.25%.

·

Reverse Repo, MSF rate & Bank

rate – Consequently, the reverse repo

rate under the LAF will remain unchanged at 6.25%, and the marginal standing

facility (MSF) rate and the Bank Rate at 8.25%.

Our Take

In line with market expectations, the RBI has kept all the key rates unchanged.

Commenting on inflation the RBI said –

“easing commodity prices at the global

level and weaker pricing power of corporates at the domestic level are having a

softening influence. Given that food inflation remains high, the inflation

outlook will be influenced by concerted efforts to break food inflation

persistence. The inflation outlook going forward will be determined by

suppressed inflation being released through revisions in administered prices,

including the minimum support prices (MSP) as well as the recent depreciation of

the rupee”.

Commenting on guidance the RBI said – “The Reserve Bank’s monetary policy

stance will be determined by how growth and inflation trajectories and the

balance of payments situation evolve in the months ahead. It is only a durable

receding of inflation that will open up the space for monetary policy to

continue to address risks to growth. While several measures have been taken to

contain the current account deficit, we need to be vigilant about the global

uncertainty, the rapid shift in risk perceptions and its impact on capital

flows. The Reserve Bank stands ready to use all available instruments and measures to respond rapidly

and appropriately to any adverse developments”.

Overall we believe the policy action by the RBI to be

neutral for the markets. From an equity market perspective, the markets might

continue to be volatile due to global cues. We advise investors to use the short

term weakness in the market to accumulate quality stocks in (1) sectors with

visibility on growth – consumption and pharma, (2) interest rate sensitive like

banking and auto, and (3) reform led sectors like oil & gas and

media. For stock opportunity please refer to our

report – “Buffetology- Be greedy when the market is fearful” sent on

14th June.

Friday 14 June 2013

Technical Notes

The Japanese Yen has been on a roller coaster ride in recent days going from a maligned currency to one of the hottest over the past month. Yesterday JPYINR settled with the sharp gain of +2.87% at 61.62 as support was seen from the Rupee weakness also in past couple of days. Today rupee recovered a large part of its losses, helped by dollar sales from a corporate and exporters, but disappointment over lack of any specific measures from the government prevented a further rise. Finance Minister P. Chidambaram's attempt to win back market confidence by pledging new reform measures and talking up the economy disappointed investors. A sell-off in global markets had hurt the domestic share market and the rupee earlier but losses were limited on hopes that the finance minister would announce some steps to prevent the rupee from sliding towards record lows by attracting foreign capital. Domestic shares, however, fell for a third consecutive session to close at their lowest level since April 17. Meanwhile Japanese stocks plunged over 6 percent to bear market territory and Asian shares slid to nine-month lows, as investors rushed to exit their positions on prospect of reduced stimulus from central banks. The question now becomes whether markets are truly optimistic about the fortune of the Japanese economy, or if the recent bullish sentiment is simply the result of the Yen being oversold. Certainly, markets were expecting the BoJ to fire up the printing presses, but yesterday's announcement of no further expansion of the monetary base in Japan in the near-term came as a surprise.

Japanese Yen futures continued their recovery, after the Bank of Japan decided against expanding its stimulus efforts. The BoJ sees the Japanese economy improving and would rather keep the possibility of additional easing in its back pocket in the event that it is needed down the road. It is important to note that the central bank is not eliminating stimulus, but rather not expanding it any further. The BoJ believes that it can achieve its current target inflation rate of 2 % by boosting the monetary base by ¥60 trillion to ¥70 trillion annually. The Yen seems to once again be gaining traction as a defensive currency, and may steal some of the greenback's thunder in this regard. There is a slew of important US economic data today and disappointing US data could drive the Yen higher. Regardless, the data is expected to add to market volatility.

Technical Notes

USDJPY slipped below 95 for the first time in over two months and all it took was a six percent collapse in Japan’s benchmark Nikkei 225 equity index. The benchmark opened gap down and extended the incredible bearish drive to an incredible 20 percent collapse in a mere three weeks. If the Bank of Japan’s (BoJ) primary goal with its stimulus regime is to revive inflation and eventually reach a 2.0 percent target, they can still find success. However, they are causing severe damage along the way. Stable financial markets are an unspoken mandate for central banks, yet the BoJ’s efforts have generated severe fluctuations. The highest, sustained level of volatility in equities since 2008 and sharp increase in JGB yields (a serious problem for the government and pension funds) is collateral damage they simply cannot endure. The only option from here is more stimulus. ‘How’ and ‘when’ are key to preventing a yen cross cave in. Prices closed above the 100-day moving average and are well above the average. The recent gains have resulted in overbought levels on the RSI, which could curb further advances in the near-term. Now JPYINR is getting support at 60.955 and below same could see a test of 60.295 levels, and resistance is now likely to be seen at 62.31, a move above could see prices testing 63.005.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

Japanese Yen futures continued their recovery, after the Bank of Japan decided against expanding its stimulus efforts. The BoJ sees the Japanese economy improving and would rather keep the possibility of additional easing in its back pocket in the event that it is needed down the road. It is important to note that the central bank is not eliminating stimulus, but rather not expanding it any further. The BoJ believes that it can achieve its current target inflation rate of 2 % by boosting the monetary base by ¥60 trillion to ¥70 trillion annually. The Yen seems to once again be gaining traction as a defensive currency, and may steal some of the greenback's thunder in this regard. There is a slew of important US economic data today and disappointing US data could drive the Yen higher. Regardless, the data is expected to add to market volatility.

Technical Notes

USDJPY slipped below 95 for the first time in over two months and all it took was a six percent collapse in Japan’s benchmark Nikkei 225 equity index. The benchmark opened gap down and extended the incredible bearish drive to an incredible 20 percent collapse in a mere three weeks. If the Bank of Japan’s (BoJ) primary goal with its stimulus regime is to revive inflation and eventually reach a 2.0 percent target, they can still find success. However, they are causing severe damage along the way. Stable financial markets are an unspoken mandate for central banks, yet the BoJ’s efforts have generated severe fluctuations. The highest, sustained level of volatility in equities since 2008 and sharp increase in JGB yields (a serious problem for the government and pension funds) is collateral damage they simply cannot endure. The only option from here is more stimulus. ‘How’ and ‘when’ are key to preventing a yen cross cave in. Prices closed above the 100-day moving average and are well above the average. The recent gains have resulted in overbought levels on the RSI, which could curb further advances in the near-term. Now JPYINR is getting support at 60.955 and below same could see a test of 60.295 levels, and resistance is now likely to be seen at 62.31, a move above could see prices testing 63.005.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

Wednesday 12 June 2013

Key Takeaways - IIP April 2013

Index of Industrial

Production (IIP) has grown at 2.0% for April 2013 (below market expectations of

~2.4%) compared to 3.4% in March 2013 (MoM) (revised upward from 2.5%)

and -1.3% in April 2012 (YoY).

Comment:

IIP headline data for April came below street

expectations. The sluggish growth in IIP was mainly on the back of

negative growth in mining & consumer durables. Additionally, muted growth in

capital goods and electricity contributed to the slowdown in growth.

Core or infrastructural industries, having a weight of

37.9% in the overall IIP, posted a relatively low growth of 2.3% in April, 2013

on the back of continued weakness in sectors like crude oil, natural gas and

fertilisers.

Outlook: Going forward, our equity markets might

continue to be volatile on account of (1) global equity market weakness due to

concerns over tapering of the US Fed quantitative easing program and (2)

concerns over rupee weakness. With the recent rupee weakness and its negative

implications for inflation, markets have priced in a unchanged repo rate in the

upcoming RBI monetary policy meet. Diesel and petrol prices are likely to be

hiked over the weekend to adjust for the inflationary impact of the rupee

weakness. The Chief Economic Adviser Mr. Raghuram Rajan has talked about

raising FDI caps across sectors to enable long-term financing of the CAD and

reduce dependence on short term foreign portfolio flows. These steps could

provide support to our markets. Over the

medium term, we expect global liquidity to be strong as global central banks are

unlikely to upset the liquidity environment, given that unemployment in

developed markets is far from comfortable and growth uncertainty is still

prevalent due to a muted fiscal policy.

We advise investors to use the short term

weakness in the market to accumulate quality stocks in (1) sectors with

visibility on growth – consumption and pharma, (2) interest rate sensitives like

banking and auto, and (3) reform led sectors like oil& gas and

media.

Sector-wise growth

indicator

· Manufacture sector growth

at 2.8% vs. -1.8% (YoY)

· Mining sector growth at

-3.0% vs. -2.8% (YoY)

· Capital sector goods

growth at 1.0% vs. -21.5% (YoY)

· Electricity sector growth

at 0.7% vs. 4.6% (YoY)

· Basic goods growth at

1.3% vs. 1.9% (YoY)

· Intermediate goods growth

at 2.4% vs. -1.8% (YoY)

· Consumer durables goods

growth at -8.3% vs. 5.4% (YoY)

· Consumer non durables

goods growth at 12.3% vs. 2.3% (YoY)

Take away of Chief Economic Advisor press confrence

Gold imports, one of the key drivers for country's

widening current account deficit, have come down in the first fortnight of June

this year, said chief economic advisor, Raghuram Rajan speaking in New Delhi.

At the same time, he tried to calm the nerves of

currency market by saying that the rupee depreciation against the US dollar is

in line with other emerging market currencies, which are also falling. The

Indian rupee tumbled to a record low at 58.98 against the greenback.

Gold imports

"Large part of rupee decline was due to dollar strength.

This may current account deficit larger than previous months. Gold imports have fallen considerably and we expect

significantly lower gold imports due to steps taken by the government," he said

speaking in New Delhi.

Last week the government had increased import duty on

gold to 8 percent, the second such hike within two quarters. The monthly gold

imports stood at around 150 ton on an average between April and May this year as

against 70 ton recorded in 2012-13.

The Reserve Bank of India too has taken some measures to curb the fettish

for gold.

"The government, SEBI and RBI are watching rupee

(exchange rate movements) closely and will undertake necessary action. Rupee is

possibly going to undervalued territory We have seen debt inflows of USD1.5

billion since May 25 this year. However, the debt outflows stood at USD 2.5

billion recently but inflows of USD 1.5 billion," Rajan said.

The central bank on Tuesday intervened to stem rupee's

sharp fall by way of asking state-owned banks to sell dollars. The local

currency recouped its early losses after hitting all time low at 58.98/USD. At

16:50 hrs, it is trading at 58.42 per US dollar.

Re depreciation & inflation

dynamics

However, the government does not like rupee volatility

as it has an impact on inflation, he said.

Indian importers especially on account of oil and gold,

are to pay at a higher rate to their overseas clients due to declining rupee. As

companies spend more, they will pass on the extra cost to consumers back home.

This will put pressure on inflation.

CAD spectrem

Accordingly, a higher import bill would further expand

the current account deficit (CAD).

"The government will undertake measures to keep CAD

under check. It will ensure that CAD will be financed. We will look to enhance

FII limits to ensure safe CAD inflows. Current Account gap is seen narrowing in

next few months," he added.

GDP Growth

Commenting on India's GDP growth, he said that growth

should pick up as Preliminary Indicators on Services (PMI) was showing a pick

up. In 2012-13, India clocked a GDP growth of just 5 percent. It is likely to be

around 6 percent in FY14, according to a market consensus.

"We are looking at ways to improve growth potential of

the economy. We are exploring ways to revive the investment cycle. The country

should focus on stable financing unlike hot money inflows (FII money)," he

concluded.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

Tuesday 4 June 2013

Monthly Report - June

USD-INR JUN

INR has traded with a weakening bias as less dovish market

expectations for Fed policy has boosted the USD and US

rates, pressuring India's ability to fund its current account

deficit. Though oil and gold prices have eased, the external

deficit is unlikely to fall enough to nullify external funding

risk for the rupee, particularly if the market's bias for pricing

in a less dovish Fed to the USD continues. Capital account

inflows following policy rate cuts have thus far failed to

support the INR on a sustained basis.

EUR-INR JUN

Stronger dollar, an ECB interest rate cut, a building

discussion on the potential of negative interest rates and a

large EUR short position (reported by the CFTC).

JPY-INR JUN

In May the yen reached a 4.5 year low having been

pressured by aggressive Bank of Japan policy juxtaposed

against rising expectations that the Fed would begin

stepping away from QE.

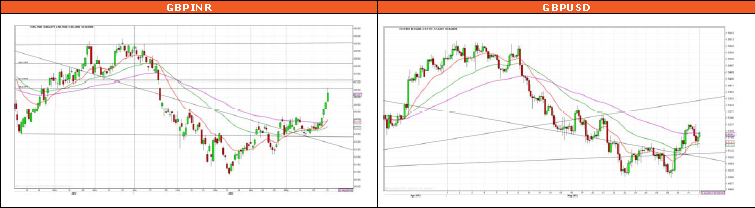

GBP-INR JUN

Bearish technicals and a broadly stronger USD all

contributed to GBP weakness in May. Outlook remain bearish

viewing the combination of low growth, elevated inflation, an

upcoming change in leadership at the BoE and negative

sentiment as GBP negatives.

Latest Update

The Reserve Bank of India continues to provide monetary stimulus, although at a cautious pace, in order to stimulate sluggish economic activity; on May 3rd,

monetary policymakers lowered the benchmark repo rate by 25 basis points (bps) to 7.25%, taking cumulative reductions to 75 bps since the beginning of the

easing cycle in January. The authorities identified two key factors behind the decision: a continuous and steep deceleration in economic growth, and an easing

in WPI inflation closer to the central bank’s tolerance threshold. While the policymakers pointed out that there is little space for further monetary easing,

market assess that the fact that wholesale price inflation weakened substantially to 4.9% y/y in April from 6.0% the month before will allow further modest

reductions in the benchmark interest rate. India’s economic performance remains subdued, challenged by a high cost of financing, constrained fiscal room and

subdued global demand conditions. A gradual improvement is in sight, however, supported by monetary easing and the government’s attempt to implement

modest economic reforms. Market is rumored with revised India’s real GDP growth forecasts downwards and now expect the economy to expand by 5½% in

2013, followed by a 6% gain in 2014. Shifts in investor sentiment will continue to be reflected in the value of the Indian rupee, as the country suffers from a

large current account deficit (equivalent to around 5% of GDP in 2013), a negative sovereign credit rating outlook (affirmed by Standard & Poor’s in May),

weak government finances, and political instability.

Market Roundup

Global markets turned jittery after Congressional testimony by Fed Chairman Ben Bernanke and minutes from the FOMC's latest policy meeting

seemed to send conflicting messages. The markets were a bit flummoxed as the Chairman predictably cited "premature tightening" as a risk to the

recovery before saying later that the Fed could begin to dial-down purchases at "one of the next few meetings." However, the Fed minutes released

same day showed "a number of participants" are prepared to slow QE as soon as June.

U.S. initial jobless claims fell to 340,000, a decrease of 23,000 from the previous week's revised figure of 363,000. Economists had expected jobless

claims to drop to about 345,000. US new home sales climbed 2.3% to a seasonally adjusted annual rate of 454,000 in April from the revised March

rate of 444,000. Economists had expected new home sales to increase by 1.9%.

Eurozone consumer confidence indicator came in at -21.9, up from April's score of -22.3. Economists were expecting a reading of -21.8 for May. The

latest reading is the highest since July 2012. Eurozone composite output index, that measures performance of the both manufacturing and service

sectors, rose to 47.7 in May from 46.9 in April. Economists expected the reading to rise to 47.2. German composite output index rose to 49.9 in May

from a five-month low of 49.2 in April.

French Purchasing Managers' Index for the service sector held steady at 44.3, the manufacturing PMI rose to 45.5 from 44.4 in April. Economists had

forecast the services index to rise to 44.5 and manufacturing index to reach 44.7. The Economic and Monetary Union (EMU) is a more stable union

today than it was a year ago, European Central Bank President Mario Draghi said. Also "markets are fully confident that the euro is a strong and stable

currency," he said in a speech in London.

German Ifo index of business confidence rose to 105.7 in May from 104.4 in April and beat estimates of 104.5 reading.

China's HSBC flash PMI fell into contraction territory for the first time in seven months in May, dropping to 49.6 from 50.4 in April, missing

expectations. “The cooling manufacturing activities in May reflected slower domestic demand and ongoing external headwinds. A sequential slowdown

is likely in the middle of Q2, casting downside risk to China's fragile growth recovery. Moreover, the further signs of labor market slackness call for

more policy support. Beijing still has fiscal ammunition to do so." HSBC Markit said.

The Bank of Japan decided to keep its monetary easing program unchanged from that announced in April and said the economy has started to pick up.

EURO ZONE - First-quarter GDP figures released this month for the euro area highlighted the enduring economic weakness in the region. The

results fell short of market expectations, particularly in the case of Germany, where both investment and exports declined sharply during

January-March (just offset by an expansion in household spending and larger drop in imports). The ECB’s expected 2013 H2 recovery still

appears far off, and recessionary conditions could well persist into the second quarter. The fact that several key developed and emerging

markets also appear sluggish – prompting a new wave of monetary policy stimulus – suggests that global growth momentum is gathering

speed more slowly than earlier anticipated. Recent weeks have seen increasing acknowledgements by policymakers regarding the absence of

a forthcoming recovery and the inability of crisis-ridden states to return to growth amid severe fiscal austerity. Even the German Finance

Minister has called for urgent action on youth joblessness, championing proposals for bilateral aid agreements with Germany’s troubled euro

zone partners. A slight uptick in the PMIs in May was a welcome development, but may prove to be an aberration, in which case the ECB may

be compelled to implement another interest rate cut (following the quarter-point reduction to 0.50% in May). Inflation is expected to rebound

somewhat after a steep decline in April, though price pressures will remain subdued through 2014.

The pound showed renewed weakness in May, with losses amounting to roughly 3% versus the US dollar reflecting weak economic data and

the general bias toward USD strength over the month. Despite the rebound in output in the first quarter (the preliminary GDP estimate

confirmed growth of 0.3% q/q in January March, following the prior quarter’s 0.3% contraction), there are few indications that the economy is

entering a meaningful recovery. The gain was driven almost entirely by a large build-up in inventories, with a small addition from household

spending. Meanwhile, private investment and exports continued to detract from growth. Disappointing retail sales data for April suggest that

consumer spending is losing steam. The fact that the government’s promised ‘rebalancing’ toward investment and trade has yet to materialize

has prompted calls for a tempering of fiscal consolidation plans. According to the IMF’s latest Article IV Consultation report on the UK

(released May 22nd), of the GBP130 billion in deficit reduction measures slated for FY 2010/11 to FY 2015/16, more than half have already

been implemented. The report also supported an expansion of the Bank of England’s (BoE) asset purchase program and use of forward

guidance by the central bank, and stressed the return of the two state-intervened banks to private ownership in order to strengthen

confidence in the financial sector. Inflation dropped sharply in April, from 2.8% y/y to 2.4%. Much of the decline was due to temporary

factors, however, and is unlikely to cause any great shift in opinions at the BoE.

Market participants’ attention is centered on Japan’s economic performance in order to assess the effectiveness of the country’s recent

unprecedented monetary policy actions. Signs are emerging that policymakers’ revitalization efforts are starting to bear some fruit: earlier

improvements in confidence are translating into a pickup in household spending, while leading indicators point to increasing economic

momentum more broadly. In addition, the external sector should receive a boost from the recent substantial depreciation of the Japanese

yen. Nevertheless, an extended equity market correction could translate into deterioration in consumer and business confidence, potentially

erasing some of the recent improvements. The country’s real GDP increased by 0.9% q/q (non-annualized) in the first quarter of the year

following a 0.3% gain in the final three months of 2012. The growth was reasonably broadly-based with the exception of weak investment

activity. Market expect the economy to expand by 1.4% (1.0% previously), followed by a 1.5% gain in 2014. While the Japanese monetary

authorities seem determined to end deflation, inflation remains in negative territory for the time being (consumer prices declined by 0.9% y/y

in March). Market assess that the period of deflation will come to an end around mid-year, with inflation creeping gradually higher towards

1.2% y/y by the end of 2014. In light of the substantial monetary policy measures announced in April, market does not foresee any material

policy changes in the near term.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

INR has traded with a weakening bias as less dovish market

expectations for Fed policy has boosted the USD and US

rates, pressuring India's ability to fund its current account

deficit. Though oil and gold prices have eased, the external

deficit is unlikely to fall enough to nullify external funding

risk for the rupee, particularly if the market's bias for pricing

in a less dovish Fed to the USD continues. Capital account

inflows following policy rate cuts have thus far failed to

support the INR on a sustained basis.

EUR-INR JUN

Stronger dollar, an ECB interest rate cut, a building

discussion on the potential of negative interest rates and a

large EUR short position (reported by the CFTC).

JPY-INR JUN

In May the yen reached a 4.5 year low having been

pressured by aggressive Bank of Japan policy juxtaposed

against rising expectations that the Fed would begin

stepping away from QE.

GBP-INR JUN

Bearish technicals and a broadly stronger USD all

contributed to GBP weakness in May. Outlook remain bearish

viewing the combination of low growth, elevated inflation, an

upcoming change in leadership at the BoE and negative

sentiment as GBP negatives.

The Reserve Bank of India continues to provide monetary stimulus, although at a cautious pace, in order to stimulate sluggish economic activity; on May 3rd,

monetary policymakers lowered the benchmark repo rate by 25 basis points (bps) to 7.25%, taking cumulative reductions to 75 bps since the beginning of the

easing cycle in January. The authorities identified two key factors behind the decision: a continuous and steep deceleration in economic growth, and an easing

in WPI inflation closer to the central bank’s tolerance threshold. While the policymakers pointed out that there is little space for further monetary easing,

market assess that the fact that wholesale price inflation weakened substantially to 4.9% y/y in April from 6.0% the month before will allow further modest

reductions in the benchmark interest rate. India’s economic performance remains subdued, challenged by a high cost of financing, constrained fiscal room and

subdued global demand conditions. A gradual improvement is in sight, however, supported by monetary easing and the government’s attempt to implement

modest economic reforms. Market is rumored with revised India’s real GDP growth forecasts downwards and now expect the economy to expand by 5½% in

2013, followed by a 6% gain in 2014. Shifts in investor sentiment will continue to be reflected in the value of the Indian rupee, as the country suffers from a

large current account deficit (equivalent to around 5% of GDP in 2013), a negative sovereign credit rating outlook (affirmed by Standard & Poor’s in May),

weak government finances, and political instability.

Market Roundup

Global markets turned jittery after Congressional testimony by Fed Chairman Ben Bernanke and minutes from the FOMC's latest policy meeting

seemed to send conflicting messages. The markets were a bit flummoxed as the Chairman predictably cited "premature tightening" as a risk to the

recovery before saying later that the Fed could begin to dial-down purchases at "one of the next few meetings." However, the Fed minutes released

same day showed "a number of participants" are prepared to slow QE as soon as June.

U.S. initial jobless claims fell to 340,000, a decrease of 23,000 from the previous week's revised figure of 363,000. Economists had expected jobless

claims to drop to about 345,000. US new home sales climbed 2.3% to a seasonally adjusted annual rate of 454,000 in April from the revised March

rate of 444,000. Economists had expected new home sales to increase by 1.9%.

Eurozone consumer confidence indicator came in at -21.9, up from April's score of -22.3. Economists were expecting a reading of -21.8 for May. The

latest reading is the highest since July 2012. Eurozone composite output index, that measures performance of the both manufacturing and service

sectors, rose to 47.7 in May from 46.9 in April. Economists expected the reading to rise to 47.2. German composite output index rose to 49.9 in May

from a five-month low of 49.2 in April.

French Purchasing Managers' Index for the service sector held steady at 44.3, the manufacturing PMI rose to 45.5 from 44.4 in April. Economists had

forecast the services index to rise to 44.5 and manufacturing index to reach 44.7. The Economic and Monetary Union (EMU) is a more stable union

today than it was a year ago, European Central Bank President Mario Draghi said. Also "markets are fully confident that the euro is a strong and stable

currency," he said in a speech in London.

German Ifo index of business confidence rose to 105.7 in May from 104.4 in April and beat estimates of 104.5 reading.

China's HSBC flash PMI fell into contraction territory for the first time in seven months in May, dropping to 49.6 from 50.4 in April, missing

expectations. “The cooling manufacturing activities in May reflected slower domestic demand and ongoing external headwinds. A sequential slowdown

is likely in the middle of Q2, casting downside risk to China's fragile growth recovery. Moreover, the further signs of labor market slackness call for

more policy support. Beijing still has fiscal ammunition to do so." HSBC Markit said.

The Bank of Japan decided to keep its monetary easing program unchanged from that announced in April and said the economy has started to pick up.

EURO ZONE - First-quarter GDP figures released this month for the euro area highlighted the enduring economic weakness in the region. The

results fell short of market expectations, particularly in the case of Germany, where both investment and exports declined sharply during

January-March (just offset by an expansion in household spending and larger drop in imports). The ECB’s expected 2013 H2 recovery still

appears far off, and recessionary conditions could well persist into the second quarter. The fact that several key developed and emerging

markets also appear sluggish – prompting a new wave of monetary policy stimulus – suggests that global growth momentum is gathering

speed more slowly than earlier anticipated. Recent weeks have seen increasing acknowledgements by policymakers regarding the absence of

a forthcoming recovery and the inability of crisis-ridden states to return to growth amid severe fiscal austerity. Even the German Finance

Minister has called for urgent action on youth joblessness, championing proposals for bilateral aid agreements with Germany’s troubled euro

zone partners. A slight uptick in the PMIs in May was a welcome development, but may prove to be an aberration, in which case the ECB may

be compelled to implement another interest rate cut (following the quarter-point reduction to 0.50% in May). Inflation is expected to rebound

somewhat after a steep decline in April, though price pressures will remain subdued through 2014.

The pound showed renewed weakness in May, with losses amounting to roughly 3% versus the US dollar reflecting weak economic data and

the general bias toward USD strength over the month. Despite the rebound in output in the first quarter (the preliminary GDP estimate

confirmed growth of 0.3% q/q in January March, following the prior quarter’s 0.3% contraction), there are few indications that the economy is

entering a meaningful recovery. The gain was driven almost entirely by a large build-up in inventories, with a small addition from household

spending. Meanwhile, private investment and exports continued to detract from growth. Disappointing retail sales data for April suggest that

consumer spending is losing steam. The fact that the government’s promised ‘rebalancing’ toward investment and trade has yet to materialize

has prompted calls for a tempering of fiscal consolidation plans. According to the IMF’s latest Article IV Consultation report on the UK

(released May 22nd), of the GBP130 billion in deficit reduction measures slated for FY 2010/11 to FY 2015/16, more than half have already

been implemented. The report also supported an expansion of the Bank of England’s (BoE) asset purchase program and use of forward

guidance by the central bank, and stressed the return of the two state-intervened banks to private ownership in order to strengthen

confidence in the financial sector. Inflation dropped sharply in April, from 2.8% y/y to 2.4%. Much of the decline was due to temporary

factors, however, and is unlikely to cause any great shift in opinions at the BoE.

Market participants’ attention is centered on Japan’s economic performance in order to assess the effectiveness of the country’s recent

unprecedented monetary policy actions. Signs are emerging that policymakers’ revitalization efforts are starting to bear some fruit: earlier

improvements in confidence are translating into a pickup in household spending, while leading indicators point to increasing economic

momentum more broadly. In addition, the external sector should receive a boost from the recent substantial depreciation of the Japanese

yen. Nevertheless, an extended equity market correction could translate into deterioration in consumer and business confidence, potentially

erasing some of the recent improvements. The country’s real GDP increased by 0.9% q/q (non-annualized) in the first quarter of the year

following a 0.3% gain in the final three months of 2012. The growth was reasonably broadly-based with the exception of weak investment

activity. Market expect the economy to expand by 1.4% (1.0% previously), followed by a 1.5% gain in 2014. While the Japanese monetary

authorities seem determined to end deflation, inflation remains in negative territory for the time being (consumer prices declined by 0.9% y/y

in March). Market assess that the period of deflation will come to an end around mid-year, with inflation creeping gradually higher towards

1.2% y/y by the end of 2014. In light of the substantial monetary policy measures announced in April, market does not foresee any material

policy changes in the near term.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

Saturday 1 June 2013

MONEY WEEKLY

Our markets ended

flat for the week. The markets lost its gains made in the earlier part of the

week as investor sentiment was affected by (1) continued concerns over tapering

of the quantitative easing program of the US Fed and its impact on global

liquidity, (2) continued declines in the Japanese equity markets and (3) further

depreciation of the rupee. The realty sector continued to suffer big declines,

with its index falling 6.3% for the week, on top of a 11.5% fall the previous

week. Banks also saw some selling, with its index falling 2.3%.

While concerns over

the Fed tapering its bond-buying program might continue for a while, we feel

that global central banks are unlikely to upset the liquidity applecart, given

that unemployment in developed markets is far from comfortable and growth

uncertainty is still prevalent. The global liquidity environment is likely to be

strong over the medium term which would support our markets. Short term weakness

in the market should be used as an opportunity by investors to accumulate

quality stocks in (1) sectors with visibility on growth – consumption and

pharma, (2) interest rate sensitives like banking and auto, and (3) reform led

sectors like oil& gas and media.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

Money Deri-Roll – June 2013

Rolls in NIFTY futures lower than last month with NIFTY rolls at 57%, lower than

6-month average of 60%, also in value terms, it is at 11308 Cr. versus

11512 Cr. (NIFTY was up by 4% in last series, number of shares

also have increased to 185 lakh versus 158 lakh

shares). On other

hand, market wide roll also lower at 77% in value terms 28602 Cr which is more than last month 23959 Cr., (in share terms also higher, as lot

of stocks have gain 5-10 % on price chart) leading to overall position of

41765

Cr Vs

35460

Cr. (higher than last month, and also highest in last three

month) in futures positions, however Roll Cost is at 0.25 which is lower than last month even after

adjusting dividend cost is positive, but declining lower than 6mth avg. of

0.53, with NIFTY cost at 0.12 (which is much lower than 0.48 avg. of 6

months),as a result Arbitrage trades have seen unwinding. Also, NIFTY/STOCK Fut.

ratio has come down to 0.25 (last month 0.35), implies market participants have

taken bets on individual stocks and not on

Index.

Nifty front PCR_OI opened at 1.07 above 1 (last month

1.05), highest level at open in last 6 months (stable zones); with

6000

PE

having highest OI across options as 51 lakh, (14 lakh shares add on

Thursday), implying PE writers are convinced NIFTY will find support around

5950-6000; on resistance side CE OI is at 6200 and

6300 (32 and 33

lakh shares), implying 6260-6320 will be crucial resistance zone; Index options

positions also has reduced to 58954 Cr (last month 60110 Cr) clearly can be attributed to

hedging being reduced positive for market. We feel in short term Nifty trading

range would be 5950-6270, as we enter the JUNE

Series.

Among stock

futures lot of sectors have shown mixed sentiment, implying it will be Stock

Specific market with in a sector also some stocks are showing more strength than

others; some of the sectors that can help Index to gain further in the JUNE.

Series, Overall OIL & GAS (heavy weights), FINANCE (HSG. FIN.),

AUTO, PHARMA, FMCG, TELECOM should be watched carefully as they have shown C-o-C

improve heavy weights. On other hand, sectors which might underperform

are

CAP.GOODS, CEMENT, INFRASTRUCUTRE, REALTY and IT.

WHAT EVER YOU EARN FROM MY CALLS PLEASE GIVE 10% PROFIT'S FOOD TO COWS AND DOGS HELP THM GOD WILL HELP YOU-!!!

Subscribe to:

Posts (Atom)